Business problem-solving

Whether you’ve already identified an issue or just suspect something’s up, we can help you to solve the problem quickly and effectively. We can also arm you with a suite of tools to put new systems and processes in place and smooth ruffled feathers and troubled waters along the way.

Business support and advocacy

Need someone to help you manage the complexities of running your business, so that you can focus on the day to day necessities? Talk to us – we can:

- save you money by taking care of your monthly accounts for a very competitive fee (plans start from only $99 plus GST a month)

- save you stress by providing you with ideas and tools to keep your business on track

- support you in your relationships with advisers such as banks and accountants

- be your advocate in undertaking negotiations and interpreting jargon.

Business ‘warrants of fitness’

Just as vehicles need regular checks to ensure they’re fit for purpose, so too could your business benefit from an independent review.

Commission a ‘Business WoF’ and we’ll compare your business’s financial and operational drivers with industry best practice, then use this information to produce an obligation-free report of conclusions and recommendations. It’s a great way to benchmark your business, and an excellent platform from which to achieve your business goals.

Business plans and planning

Where are you now? Where do you want to be? How are you going to get there? And how will you know that you’re there?

Together, we can find the answers to these questions, put them in writing and produce a comprehensive business plan – your personal roadmap to achieving your business goals.

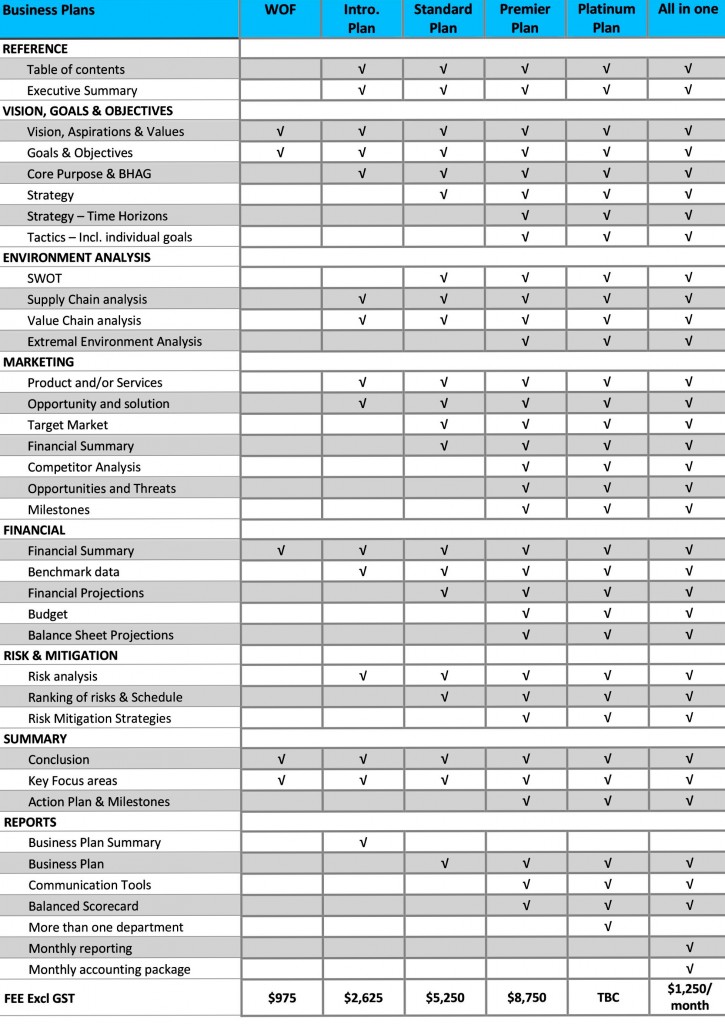

We can tailor-make a plan to reflect your unique situation, or offer you one of four fixed-priced business plan packages. The packages have been designed to suit specific business needs:

- The Introductory Plan is ideal for small businesses seeking concise strategies for purposes such as loan applications.

- The Standard Plan is for medium-sized businesses, with additional features such as strategy sessions, internal and external environment and SWOT analyses, risk-mitigation strategies and monitoring and measurement tools.

- The Premium and Platinum Plans are best for larger, multi-business-unit enterprises requiring highly detailed business plans that include competitor analysis, marketing strategies, risk-management strategies and in-depth and long-term financial projections.

Business tools

As well as benefiting from Pennington Consulting’s extensive experience and expertise, you’ll have access to a wide range of tools that:

- have been tested and proven in New Zealand and around the world

- enable you to implement best-business practice with the cost and hassles of researching it yourself

- provide invaluable insights into the way you do business – and potential opportunities for improvement

- enable you to compare and benchmark your business’s performance with that of others in and beyond your industry.

Business change management

When your business has to change – perhaps because of uncontrolled growth or unexpected shrinkage – we can help you to identify and manage both your internal and external threats and opportunities. If appropriate, we can also:

- value your business

- develop strategies for succession planning, business sale and loan applications.

Monthly and annual accounting and comparative analysis and advice

We can save you precious time and energy by:

- preparing your GST, payroll and monthly and annual financial statements for a very competitive price

- providing regular reports and monitoring your cash flow

- comparing your financial performance to the figures in previous years, and analysing the differences

- identifying and developing management, growth, diversification or divestment opportunities

- liaising with your tax adviser on your behalf.

Our accounting services also include budget advice and preparation.

Liaison with external advisers and agencies

As a Pennington client your financial accounts will be prepared using the online Xero platform. This enables us to consolidate the data and liaise directly with your tax adviser at year end – reducing your costs and freeing up your adviser to focus on giving you tax advice and guidance.

We can also prepare and provide budgets and financial statements for external advisers such as banks.

Terms and Conditions of Service

These Terms of Engagement set out the standard terms on which Pennington Consultancy Limited trading as Pennington’s Accounting & Business Services (we or us) provide services to clients (you). If our engagement includes different terms, then these will be documented to you. The Terms of Engagement should be read in conjunction with the attached Information for Clients document.

- Who will work with you? We will tell you who will be responsible for the service(s) being provided to you. That person will have the appropriate skill and experience to undertake the work requested. If that person is senior within Pennington’s Accounting & Business Services, then where possible, work will be delegated to a lower charge-out staff member but will be supervised and reviewed by the senior person. If the designated person is junior within Pennington’s Accounting & Business Services, then from time-to-time, the work will be peer reviewed to ensure it is accurate.

- Duty of care: Our duty of care is to you or to the organisation that has engaged us and is not to any other person or entity. Our advice is to you, our client, and is not designed for any third party. Before any third party may rely on our advice, we must agree to this in writing. Unless required by law, you may not provide our advice to any third party or submit it to a government authority without our agreement.

- How we charge: Our normal policy is to operate timesheets and charge via an hourly rate. The hourly rate of individuals engaged in your work can be provided on request. If requested, written estimates of our fees can be provided. These are a guideline only and are based on our professional judgement of how long a job may take which in turn is based upon what is usually limited information available at the time. Estimates should not be regarded as a maximum, or a fixed fee quotation, and are likely to vary once the engagement commences. Where requested and where all the appropriate information is available, a quotation can be provided. All quotations will be in writing, and we will make every endeavour to operate to that quoted amount subject to there not being a variation to the engagement. If a variation does occur to the engagement, then a quotation can be provided to undertake that variation. If a quotation is not requested, then we will operate on our normal hourly rate schedule.

- Rate changes: From time to time, we will adjust the hourly rate of our staff. If this occurs within a contract/quoted service, then we will discuss the rate change with you and come to a mutually agreed outcome.

- Expenses and disbursements: Our hourly rate schedule includes a charge for equipment use and sundry office expenses. This includes mobile, laptops, and general office expenses. It also includes all or part of courier charges, photocopying, large scale postage, phone calls (local and international). It does not include third party fees namely software subscriptions, accommodation, airfares, vehicle travel rates, meals, and parking expenses. Any out-of-pocket expenses and disbursements will be on-charged to you at cost and a full breakdown of those expenses can be provided upon request.

- Invoicing and payment: For large contracts, advance payments and progress payments may be requested and these can then be substantiated via submission of timesheets and monthly invoices. Our usual recommended practice is to provide an annual estimate which can be broken down into manageable monthly instalments paid in advance on the 20th of each month. All invoices will be emailed to the designated person and a statement is not normally sent unless there are arrears on your account.

- GST: GST is payable by you on our fees, charges and disbursements. If work is performed offshore or consumed offshore, then GST may not be applicable. If our engagement is one where some charges are GST-exempt or zero-rated, then this will be clearly shown on the invoice.

- Fee dispute: We keep our charges reasonable on the expectation we will be paid promptly. If you wish to dispute an invoice, please do so immediately rather than just not pay it and wait for a follow up from us. Fee disputes should be in writing to us, outline the grounds for the dispute, and your desired outcome. It is expected that you pay any amount not in dispute by the due date, leaving only the disputed amount to be resolved.

- Payment default: Where invoices are not paid on time, we reserve the right to stop work and to charge interest at a rate equal to 8% above the ASB Bank overdraft lending rate, calculated on a daily basis from the due date. We reserve the right to recover any unpaid amounts and you will be responsible for all costs incurred by us in recovering the unpaid amount.

- Third party payment of our fees: There will be instances where we are undertaking the work for you, but you have an arrangement where the payment is being made by a third party. In these instances, the invoice will be sent to the third party but if payment is not made, or payment is delayed, then you will be responsible for making payment to us and you would need to recover payment from that third party.

- Conflicts of interest: If there is a possible conflict of interest, then this will be disclosed prior to work commencing. If a conflict of interest arises or has the possibility of arising during the engagement, then this will be discussed with you. Pennington’s Accounting & Business Services is experienced in operating with several clients and has procedures in place to ensure that confidential information belonging to one client is not shared with another client. We have procedures in place to deal with issues that arise if the interests of two or more client’s conflict. Our acting for you does not restrict us acting for other clients on separate matters by reason only that their engagement with Pennington’s Accounting & Business Services may be different to yours.

- Accuracy of information: You warrant that all information you provide to us is accurate, lawful, and not misleading and in turn, we warrant that as much as we can reasonably foresee, the advice we provide to you is accurate. We will be entitled to rely upon the accuracy of all information provided by you, or by others on your behalf, without independently verifying it. We do not accept responsibility for advice provided which is partially based on incorrect information supplied from a third party or governmental agency.

- Privacy: Pennington’s Accounting & Business Services has a well-documented privacy policy ensuring we take all practical steps to reasonably protect your information. This includes password protected and encrypted computer hardware and soft data; password protected cell phones and locked offices. Personal information will only be collected to enable us to complete the contract for which we are engaged. If you are an individual, under the Privacy Act 2020, you have the right of access to, and correction of, your personal information held by us.

- Confidentiality: We will hold in confidence all information concerning you or your affairs that we acquire during the engagement, unless requested to supply any information as the result of a request from a government agency under its statutory powers. As a member of ATAINZ, our work and files are subject to the review rules of ATAINZ, under which compliance with professional standards by members is monitored. These procedures and rules require us to disclose to ATAINZ, its reviewers and its disciplinary bodies our files, including client information. By allowing us to undertake any engagement (whether an engagement letter is signed by you), you acknowledge that if a request is received, our files relating to any engagements will be made available to ATAINZ, its reviewers and its disciplinary bodies. These parties are obliged to keep all information confidential.

- Intellectual property: Unless stated in some other agreement, all copyright and other intellectual property arising from the engagement or created by us in conjunction with the advice provided to you will remain our property.

- Termination: Unless specified in a different agreement, you may terminate our agreement at any time. We may, on reasonable notice to you, terminate our engagement at any time. If our engagement is terminated by you or us, then you must pay us up to the date of termination all expenses and disbursements incurred by us to that date. If advanced payments made exceeds work undertaken by us, a refund will be given.

- Retention of files and documents: We will retain all your files and documents while money is owed to us. We keep all files relating to your engagement for at least 3 years after the engagement has ended.

- Electronic communications: Our preference is to supply all material and advice in electronic format. Although we take all normal and reasonable security precautions, we cannot warrant that these communications will be complete, secure and free from viruses or other defects or will not be delayed or fail to be received. If you do not consent to the use of electronic communication while providing the Services, you should notify us in writing.

- Limitations of obligations: We are not responsible for any failure to advise on any matter that falls outside the scope of our engagement nor to provide updates to that advice after the initial advice has been given.

- Limitations of liability: We will not be liable, whether in contract, tort (including negligence) or otherwise, for (a) Any loss of profit or revenue, exemplary damages or any indirect or consequential loss or damage howsoever described or claimed or (b) Any loss or damage to the extent it is attributable to your conduct or a failure by you to take reasonable care of your own interests.

- Consumer Guarantees Act 1993: Where you are acquiring our services for the purposes of a business, the Consumer Guarantees Act 1993 will not apply.

- Non-disclosure Rights: Tax advice is subject to non-disclosure rights under the Tax Administration Act 1994 and may also be subject to legal privilege. If so, the Inland Revenue cannot require you to provide all the advice given to them. You should not disclose tax advice to any other party, including the Commissioner of Inland Revenue and any of his/her officers without first obtaining professional advice. If the Inland Revenue request documentation, please seek advice as to what you are required to disclose. Disclosure to any other person may void the non-disclosure right.

- Personal Tax Implications: Some of the matters on which we advise (e.g., employee share schemes, superannuation funds) may have personal tax implications for directors and employees. Unless advising on such personal tax implications is expressly included in the Services, we will not bear any liability to you or any relevant directors or employees in respect of those personal tax implications. You indemnify us against any claim by any such directors or employees in this respect.

- General Authority: You agree that we will have a general authority to deposit funds belonging to you (including income tax and GST refunds) to our trust account. Funds in our trust account will be handled according to the rules and standards of ATAINZ. To the extent permitted by those rules and the professional standards, we may apply funds held in trust in satisfaction of amounts owing to us by you.

- Personal Guarantee: In some cases, we may require you to sign a personal guarantee for full payment of all fees and costs due to Pennington’s Accounting & Business Services. If we have assessed you to require this guarantee, you will be required to sign Appendix C in your engagement letter. Please note that you are entitled to seek independent legal advice before signing any personal guarantee.

- Disputes: The parties undertake to use all reasonable efforts in good faith to resolve any dispute which arises between them. If the parties fail to resolve the dispute, then the parties will try to settle their dispute by mediation before resorting to litigation. Either party may initiate mediation by giving written notice to the other party. The mediator should be agreed by the parties, but if the parties cannot agree on one within five business days after the mediation has been initiated. Before the mediation commences, the parties and the mediator must sign a mediation agreement in an agreed form.

- . Anti-Money Laundering and Foreign Account Tax Compliance We must comply with all laws binding on us in all applicable jurisdictions, including (but not limited to) (a) The Anti-Money Laundering and Countering Financing of Terrorism Act 2009 (AML/CFT Act); and (b) The United States Foreign Account Tax Compliance Act, the intergovernmental agreement between the United States and New Zealand relating to it, and relevant provisions of the Tax Administration Act 1994 (together referred to as FATCA). Where required by the AML/CFT Act, FATCA or any other law binding on us (in any applicable jurisdiction), we will perform client due diligence and account monitoring, keep records, and report any unusual or suspicious transactions; and we may be required to assist any bank or other entity with whom we transact as your agent, or with whom we deposit money on trust for you, to comply with that entity’s legal obligations in any jurisdiction, and we may require you to promptly provide information and documents for these purposes from time to time. These may relate to you, any other relevant person (for example, any beneficial owner), the source of funds, the transaction, the ownership structure, tax identification details and any other relevant matter. We may retain the information and documents, provide them to a bank or other entity (where applicable) to deal with in accordance with their terms, and disclose them to any law enforcement or regulatory agency or court as required by law. We, the bank or other entity may: suspend, terminate, or refuse to enter into a business relationship; delay, block or refuse to process a transaction (including by refusing to handle and deposit money on trust for you); and report a transaction, without notice if the required information or documents are not promptly provided or it is suspected that the business relationship or transaction is unusual, may breach any applicable law or may otherwise relate to conduct that is illegal or unlawful in any jurisdiction.

- General: If there is any conflict between these terms and a specific contract or our engagement letter, then the contract or the engagement letter will have precedence.

Disclaimer: While every care has been taken to supply accurate information, errors and omissions may occur. Accordingly, Pennington’s Accounting & Business Services accepts no responsibility for any loss caused because of any person relying on the information supplied.

Need to know more? Check out the 5 reasons to choose Pennington Consultancy or get in touch – we’re an easy email or phone call away.